Happy Diwali Status in English is rising tremendously each year. One of the most significant benefits of simply just Sending Happy Diwali

Status in English for Whatsapp and Facebook vs making calls is usually that you could reach many people in a short time. Search for Happy Diwali

Status for Boyfriend and Girlfriend in English and

http://happydiwali2018.likesyou.org/category/diwali-status/ will likely be the very first website that comes up. Generally if Google rates a site consequently higher it should have a fairly good explanation. Updatepedia is among the more advantageous solutions to choose from. Therefore if you want advice about

One Line Short Status on Happy Diwali for Husband and Wife. Appreciation to the Updatepedia because you will find the

great Collection of Best Status on Happy Diwali in English which is often the innovative poet you would like to be. It’s like appointing a 24/7 specialist who is able to give Two Line Status on Happy Diwali for GF / BF or simply a pleasant greeting for somebody who you would like to connect with. Imagine if somebody has 200 individuals to greet? Exactly how will that individual greet everybody? Unlikely! But right now that you could greet lots of people pretty quickly by using

Best Status on Happy Diwali for Friends or even would you bulk Message everybody the comparable words? Not too extraordinary is it in case you stick to forward Wishing you a Happy Diwali

Status to your contacts. Right now you may be questioning from the large number of sites available that one should I go with for wishing you a Happy Diwali

Status for Parents. You may be sure that Updatepedia.com could have what exactly you need. Happy Diwali everybody, stay safe and have fun.

Happy Diwali Status in English for Whatsapp & Facebook

Best Happy Diwali Status in English

May millions of lamps illuminate Ur life with endless joy,prosperity,health and wealth forever.

———-

Diwali Status in English for Boyfriend

Light a lamp of love! Blast a chain of sorrow!Shoot a rocket of prosperity!

———-

Fire a flowerpot of happiness! Wish u and your family “SPARKLING DIWALI”.

———-

Happy Diwali Status for Girlfriend in English

My greeting to you for happiness, peace, progress and prosperity in your life..Enjoy and celebrate… Happy Diwali.

———-

May you live your life like the festival of Diwali, happy healthy and wealthy.

———-

Short Deepavali Status in English

Wish you and your family a bombastic Diwali, Have loads of fun and loads of fun.

———-

May the light that we celebrate at Diwali show us the way and lead us together on the path of peace and social harmony.

———-

Happy Diwali Status for Husband

You are invited to the festival of Diwali of this world and your life is blessed.

———-

Let this Diwali burn all your bad times and enter you in good times.

———-

Let the divine light of Diwali spread into ur life wit peace, prosperity and happiness. Happy Diwali

———-

Diwali Wishing Status for Husband & Wife

May you all attain the inexhaustible spiritual wealth of the Self, Happy Diwali.

———-

Just wanted to wish a little sunshine back into the heart of someone who gives it away all year long. Happy Diwali!

———-

Best Status on Happy Diwali for Friends May peace transcend the earth. Happy Diwali

———-

May peace transcend the earth. Happy Diwali.

———-

May this Diwali be as bright as ever.

———-

Wishing u and Ur family a very “HAPPY DIWALI”.

———-

May you all attain the inexhaustible spiritual wealth of the Self.

Status on Happy Diwali for Girlfriend

I’m maachis and you’re pataka, Together we are and it will be double dhamaka!!!

———-

May the blessings, prosperity and wealth grow in your life like the whatsapp sharing. 🙂

———-

Wishing you a Happy Diwali Status for Wife

Have a crackling Diwali. May this season bring good luck and happiness to u.

———-

The festival of lights is just around the corner, wishing you all a very Happy Diwali..

———-

Hope this diwali brings contentment to your life along with the key to success.

———-

Before you light up your candles and diyas, allow me to wish you a Happy Diwali.

———-

May the festival of lights brighten up you and your near and dear ones lives

———-

The festival of lights is just around the corner wish you all a Very Happy Diwali.

———-

If u want to become a great man in the world. Spend your life like a Diwali Diyas.

———-

May the beauty Of Diwali season fill your home with happiness..

———-

May you all attain the inexhaustible spiritual wealth of the Self..

———-

Lets fill our home with prayers and lights not with fumes and crackers – Happy Diwali

———-

Rejoice on this blessed occasion by spreading joy with your friends and loved ones.

———-

Light a lamp of love! Blast a chain of sorrow! Shoot a rocket of prosperity! Fire a flowerpot of happiness!

———-

On this diwali, I am sending you a diya of my love, I hope you will keep it lighted forver.

———-

May your life be filled with as much happiness as there are crackers lighting up the sky.

———-

Diwali night is full of lights, may your life be filled with colors and lights of happiness. Happy Diwali!

———-

Let me make your Diwali more colorful with the lights of wishes of my heart. Happy Diwali..

———-

Wishing you a year rich with wisdom, light and love.. Happy Diwali

———-

Happy Diwali Status

Lets fill our home with prayers and lights not with fumes and crackers – Happy Green Diwali

———-

With a hope that you attain success and bliss with every light that is lit on the day of DIWALI -Happy Diwali

———-

May the beauty Of deepavali season fill your home with happiness..

———-

Sending you smiles for every moment of your special day. Have a wonderful time and a very Happy Diwali

———-

The festival of lights is just around the corner wish you all a Very Happy Diwali..

———-

May the festival of lights brighten up you and your near and dear ones lives

———-

Sending you smiles for every moment of your special day. Have a wonderful time and a very Happy Diwali.

Diwali night is full of lights, may your life be filled with colors and lights of happiness. Happy Diwali..

———-

Life with you is like diwali, so lets promise to be together like this forever. Wish you a very Happy Diwali

———-

You are invited to the festival of diwali of this world and your life is blessed.

———-

May you all prosper gloriously on the material as well as spiritual planes..

———-

Latest Happy Diwali Status

Hope this Diwali brings contentment to your life along with the key to success.

———-

You are invited to the festival of Diwali of this world and your life is blessed.

———-

The festival of light is full of delight and Let me double the charm of your Diwali night. Happy Diwali my dear.

———-

May the divine light f Diwali Spread into your life peace, prosperity, Happiness And Good Health.

———-

The festival of lights is just around the corner wish you all a Very Happy Diwali..

———-

Life with you is like Diwali, so lets promise to be together like this forever.

———-

Green Diwali – Let’s fill our homes with prayers and lights, not with fumes and crackers.

———-

Just wanted to wish a little sunshine back into the heart of someone who gives it away all year long. Happy Diwali!

———-

Life with you is like Diwali, so lets promise to be together like this forever.

———-

On this Diwali, I am sending you a diya of my love, I hope you will keep it lighted forever.

———-

I want to send my hearties wishes on the “special occasion of Diwali festival Hope u enjoy and do lots of fun.

———-

During this festival season, may your luck with cards stays by your side at all times! Happy Diwali!

———-

Celebrate this years Diwali with a lot of Fun and frolic with your friends and relatives. Happy Diwali .

———-

Fortunate is the one who has learned to Admire, but not to envy. Good Wishes for a joyous Diwali.

———-

Your sparkling presence added a glow to my Diwali…Making each moment special…

———-

Let me make your Diwali more colorful with the lights of wishes of my heart. Happy Diwali..

———-

Let us keep Diwali holding it close to our hearts for its meaning never ends and its spirit is the warmth joy of remembering friends.

May you all prosper gloriously on the material as well as spiritual planes..

———-

This Diwali I wish you get a lot of crackers but you don’t get a match box to lit them. Save environment, so no to crackers.

———-

May the festival of lights encircle your life with immense Joy and Happiness.Success comes at your doorsteps. Happy Diwali.

———-

May millions of lamps illuminate Ur life with endless joy,prosperity,health and wealth forever.

———-

Happy, Happy Diwali! I hope the day has been blessed with the presence of those you love most, and many magical moments!

———-

New Happy Diwali Status

The truth is that existence wants your life to become a festival because when you are unhappy, you also throw unhappiness all around.

———-

It’s The Season To Pay A Visit To All Our Friends And Relations To Hand Them Over Sweets And Presents, Happy Diwali…

———-

Eight for your bright full future cracker for your demolish of your failure, Rangoli for your colorful life.Happy Diwali..

———-

The true spirit of Diwali is in the light it brings May the diyas and fireworks brighten your life with joy ! Happy Diwali !

———-

It’s the “Festival of Lights” today, It’s again the day of Diwali, It’s time to dress up folks,It’s time to adorn the thali.

———-

Today I feel gifted and blessed that my Diwali is full of affection, love, celebrations as it was always. May God always keep his blessings on us like this.

———-

May this Diwali Light up new dreams, fresh hopes, undiscovered avenues, different perspectives, everything bright, beautiful and fill Ur days.

———-

Paying respects to the gods,And decorating for them the thali,This is what the occasion is all about,This is the spirit of Deepavali..

———-

May the Goddess Lax mi bless you with prosperity and good luck.Happy Dhanteras And DIPAWALI to u and your FAMILY.* Happy Diwali *.

———-

I Pray to God to give U Shanti, Shakti, Sampati, Swarup, Saiyam, Saadgi, Safalta, Samridhi, Sanskar, Swaasth, Sanmaan, Saraswati, aur SNEH. SHUBH DIWALI.

———-

I’m Maachis and You’re Pataka, Together We Are and It Will Be Double Dhamaka…!!!

———-

Wish you and your family a bombastic Diwali, Have loads of fun and loads of masti.

———-

With a hope that you attain success and bliss with every light that is lit on the day of DIWALI. Happy Diwali

———-

Wishing you a year rich with wisdom, light and love.. Happy Diwali

———-

May the beauty of this festival of lights, Fill your home with happiness, prosperity, joy and never ending Success stories.

Lets fill our home with prayers and lights not with fumes and crackers. Happy Green Diwali

———-

May peace transcend the bridge. Happy Diwali 2016

———-

May the glow of prosperity, happiness and joy brighten your days in the year ahead.Aap chand ki tarah jagmagate rahai. Happy DIwali. Happy Deepavali.

———-

Happy Diwali Status 2018

May the beauty Of deepavali season Fill your home with joy, And may the coming year Provide you with all That bring you joy!

———-

Dear all, Wish u and your family a very happy diwali and prosperous new year. May God fulfill all your wishes in wealth, health and happiness in your life.

———-

May the gift of happiness and prosperity fill your heart and home with joy on Diwali and always.. Happy Diwali

———-

On this diwali, I am sending you a diya of my love, I hope you will keep it lighted forver.

———-

The festival of lights is just around the corner, wishing you all a very Happy Deepavali .

———-

Lets fill our home with prayers and lights not with fumes and crackers – Happy Diwali

———-

On Diwali, I wanted to send you wishes for a year filled with prosperity, health and lots of fun! Hope you have a happy Diwali!

———-

Wishing u and Ur family a very “HAPPY DIWALI”.

———-

On this great day I wish you a very wonderful happy diwali and may god help you every time in your life..

———-

The happiest of wishes for a Deepawali, that will be happy in every way for someone like you.

———-

The festival of lights is just around the corner wish you all a Very Happy Diwali.

———-

Candle nhi to kya hum dil se deep jalayenge..happy deepawali..

———-

With a hope that you attain success and bliss with every light that is lit on the day of DIWALI –Happy Diwali

———-

May the festival of lights brighten up you and your near and dear ones lives

———-

It is time to forget the past and celebrate a new beginning. Happy New Year.

———-

Diwali night is full of lights, may your life be filled with colors and lights of happiness. Happy Diwali!

———-

You are invited to the festival of diwali of this world and your life is blessed.

Instead of brusting a pataka, date a pataka & celebrate an eco-friendly Diwali

———-

In 2017 Parents worry about what their sons download and what their daughters upload on the internet.

———-

Life with you is like diwali, so lets promise to be together like this forever. Wish you a very Happy Diwali!

———-

May you all prosper gloriously on the material as well as spiritual planes..

———-

May the beauty of this festival of lights, Fill your home with happiness, prosperity, joy and never ending Success stories- Happy Diwali 2016

———-

Happy Diwali Status 2K18

Dοn’t bring your 2016 issues into 2017. Ηave a new Μind set to do Νew things for the Νew year. Cheers tο the new Υear. Μay it be a Μemorable one. Happy Νew Υear.

———-

Diwali, the most desirable festivals of terrorist, they wish each other by saying: “Have a blast”

———-

Happy, Happy Diwali! I hope the day has been blessed with the presence of those you love most, and many magical moments!

———-

No Facebook no wahatsapp…becoz diwali days is Up.

———-

Lets fill our home with prayers and lights not with fumes and crackers – Happy Diwali

———-

Sending you smiles for every moment of your special day. Have a wonderful time and a very Happy Diwali.

———-

May peace transcend the bridge- Happy Diwali 2016

———-

Give Out Children A Green Future. Say No To Fireworks.

———-

Happy full glow diwali dosto..

———-

May peace transcend the bridge- Happy Diwali 2016.

———-

May each and every day of yours be renewed with lots of happiness and love. Happy New Year.

———-

I honestly hope each and every one of you have the best year ever in New Year.

———-

Lamp is lighting and bulb is glowing, what are you doing…

———-

D-Diya, I-Ishwar, W-Worship, A-Auspicious, L-Light, I-Indian.

———-

On this diwali, I am sending you a diya of my love, I hope you will keep it lighted forver.

Don’t let the shadows of yesterday spoil the sunshine of tomorrow. Live for today.

———-

Don’T Act Mean, Go Green. Celebrate An Eco Friendly Diwali This Year.

———-

Test the light and get ready for night.

———-

On this Diwali, Avoid saying this to terrorist: “Have a Blast”

———-

The festival of lights is just around the corner wish you all a Very Happy Diwali..

———-

Life is a festival only to the wise.

———-

As you celebrate this holy occasion, you are wished the brightest moments that Diwali can bring, lots of love and laughter to fill your days with cheer and a New year that is sure to bring you, the best of everything.Happy Diwali!

———-

Life with you is like diwali, so lets promise to be together like this forever. Wish you a very Happy Diwali

———-

Cheers to the New Year. May it be a memorable one. Happy New Year.

———-

May your life be filled with as much happiness as there are crackers lighting up the sky.

———-

My New Year’s 2017 resolution is to stop hanging out with people who ask me about my New Year’s resolutions.

———-

With a hope that you attain success and bliss with every light that is lit on the day of DIWALI -Happy Diwali

———-

I wish this year has lesser disasters, lesser hate, lesser accidents and loads of love. Happy New Year.

———-

New Diwali Status

Wishing you a year rich with wisdom, light and love… Happy Diwali

———-

We burn crackers of 600 crores but allocated only 450 cr for interplanetary space mission. #HappyDiwali

———-

Every year we burn 600 crores for firecrackers, I wish we could donate that to ISRO for more worthy deeds.

———-

As the New Year dawns, I hope it is filled with the promises of a brighter tomorrow. Happy New Year!

———-

People treat New Year’s like some sort of life-changing event. If your life sucked last year, it’s probably still going to suck tomorrow.

———-

When I thought about the evils of drinking in the New Year, I gave up thinking. —- You know it’s time for a New Year’s resolution to lose weigh.

———-

Sending you smiles for every moment of your special day. Have a wonderful time and a very Happy Diwali

———-

Don’t launch your rocket, it may escape earth for mars.

It’s Deepavali. Not Divali. Certainly not #Diwali. We did not make it. Please let’s not break it. #SayDeepavali

———-

May the coming year bring more happiness to you than last year. May you have an amazing year. Happy New Year.

———-

Diwali night is full of lights, may your life be filled with colors and lights of happiness. Happy Diwali..

———-

HAPPY DIWALI TO YOU! may you celebrate it well surrounded by family,friends,and lots of love and remember.. !

———-

Be lovable and keep calm..Happy diwali.

———-

Μay this new Υear bring many οpportunities yοur way, Tο explore every joy οf life & turning Αll your dreams Ιnto reality & all yοur efforts Ιnto great Αchievements.

———-

Μay you take Α leap forward Τhis Νew Year, Τake on Νew Adventures, Step on Νew roads that yοu can explore, Αchieve new Ηeights … Ηave a Happy Νew Year.

———-

Write it on your heart that every day is the best day in the year.Cheers to a New Year and another chance for us to get it right.

———-

Breathing the Air in Mumbai for One Day During Diwali Equivalent to 113 Cigarettes. Change this, Celebrate an eco-friendly and Happy Diwali

———-

Wishing You A Year Filled With Great Joy Peace And Prosperity Have A Wonderful Year Ahead Happy New Year 2017!!!

———-

Latest Diwali Status

This diwali.. Go for traditional shopping. Online retailers are trolling and loli’ng around.

———-

Green Is The New Black. Have A Eco-Friendly Diwali.

———-

Let me make your Diwali more colorful with the lights of wishes of my heart. Happy Diwali..

———-

May the beauty Of deepavali season fill your home with happiness..

———-

If u want to become a great man in the world. Spend your life like a Diwali Diyas.

———-

Burst Crackers If You Want To Spoil The Nature.

———-

Wishing you a year rich with wisdom, light and love.. Happy Diwali

———-

Let this diwali burn all your bad times and enter you in good times. Happy Deepavali.

———-

We are Ιn the last mοnth of the Υear. Just felt Ι should thank Εveryone who made Μe smile this Υear. Yοu are one οf them so Ηere’s a big Τhank You.

———-

Let me make your Diwali more colorful with the lights of wishes of my heart. Happy Diwali

———-

Celebrate An Environmentally Safe Diwali

Rejoice on this blessed occasion by spreading joy with your friends and loved ones.

———-

In 2017 I will not stress myself out about things I can’t control or change.

———-

New Year is the time when, all your hopes are new, so are your aspiration, new are your resolutions and new are your spirits… so here’s wishing everyone a very promising, fulfilling and a very happy New Year 2017!

———-

This Diwali, leave the bombs, rockets and firecrackets for Indian army. Let’s celebrate a peaceful & noiseless Diwali. Happy Diwali

———-

May the beauty Of deepavali season fill your home with happiness..

———-

HAPPY DIWALI TO YOU! may you celebrate it well.surrounded by family, friends, and lots of love and remember..

———-

May you all attain full inner illumination, May the supreme light of lights enlighten your understanding.

———-

May you live your life like the festival of Diwali, happy healthy and wealthy. A Very Very Happy Diwali..

———-

The festival of light is full of delight Let me double the charm of your diwali night Happy Diwali!

———-

May you be blessed with happiness and well being to last through the year. Happy Diwali..

———-

Latest Diwali Status 2018

My greeting to you for Happiness, Peace, Progress and Prosperity in your life.. Enjoy and Celebrate.. Happy Diwali.

———-

May the gift of happiness and prosperity fill your heart and home with joy on Diwali and always.Happy Diwali

———-

Let me make your Diwali more colorful with the lights of wishes of my heart. Happy Diwali..

———-

May the light that we celebrate at Diwali show us the way and lead us together on the path of peace and social harmony.

———-

Just wanted to wish a little sunshine back into the heart of someone who gives it away all year long. Happy Diwali!

———-

This Diwali I wish you get a lot of crackers but you don’t get a match box to lit them. Save environment, so no to crackers.

———-

Let this diwali burn all your bad times and enter you in good times.

———-

May this diwali bring you the utmost in peace and prosperity.

———-

Diwali night is full of lights, may your life be filled with colors and lights of happiness. Happy Diwali!

———-

May the festival of lights brighten up you and your near and dear ones lives.

———-

May your life be filled with colors and lights of happiness. Happy Diwali Everyone

Diwali night is full of lights, may your life be filled with colors and lights of happiness. Happy Diwali!

———-

Life with you is like diwali, so lets promise to be together like this forever. Wish you a very Happy Diwali

———-

May the light that we celebrate at Diwali show us the way and lead us together on the path of peace and social harmony. Happy Diwali

———-

Sending you smiles for every moment of your special day. Have a wonderful time and a very Happy Diwali.

———-

Happy, Happy Diwali! I hope the day has been blessed with the presence of those you love most, and many magical moments!

———-

HAPPY DIWALI TO YOU! may you celebrate it well. surrounded by family, friends,and lots of love and remember..

———-

This Diwali I wish you get a lot of crackers but you don’t get a match box to lit them. Save environment, so no to crackers. Happy Diwali

———-

May you all attain full inner illumination, May the supreme light of lights enlighten your understanding. Happy Diwali

———-

On Diwali, I wanted to send you wishes for a year filled with prosperity, health and lots of fun! Hope you have a happy Diwali!

———-

Happy Diwali Status message

May this Deepawali bring you all a cracker with Joys, Firework with Happiness and Prosperity and Subh Laabh from Ganesh Ji. Happy Diwali.

———-

May the Beauty of Deepawali Season Fill your Home With Happiness, and May the Coming Year provide You with all That bring You Joy happy diwali.

———-

May this diwali Light up new dreams, fresh hopes, undiscovered avenues, different perspectives, everythin bright and beautifulfil and fill ur days with pleasant surprises and moments.

———-

May the Goddess Laxmi bless you with prosperity and good luck. Happy Dhanteras And DIPAWALI to u and your FAMILY. Happy Diwali

———-

Let us keep Diwali holding it close 2 our hearts for its meaning never ends and its spirit is the warmth and joy of remembering friends.. Happy Diwali

———-

May the joy, cheer,Mirth and merriment Of this divine festival Surround you forever. May the happiness, That this season brings Happy deepavali.

———-

Paying respects to the gods, And decorating for them the thali, This is what the occasion is all about, This is the spirit of Deepavali..

———-

May millions of lamps illuminate ur life with endless joy, prosperity, health and wealth forever. Wishing u and ur family a very “HAPPY DIWALI”

———-

Light a lamp of love! Blast a chain of sorrow! Shoot a rocket of prosperity! Fire a flowerpot of happiness! Wish u and your family “SPARKLING DIWALI”

———-

May the shimmering diyas the crackiling fireworks sparkle up your life with happiness.. have a mastiful dhamakedar diwali

———-

May the Divine light of diwali spread happiness,peace and prosperity to you and your family ! May the lights of this auspicious festival fill your life with the enternal glow.

A matchstick glows for a few seconds,A candle glows for a few hours, A sun glows for a day..I wish u glow forever and ever and ever! Happy Diwali to u and ur family!!

———-

This Is To Formally announce that I have started accepting Diwali gifts in ROKDA and CHEQUES. Avoid last day rush. Send now. HAPPY DIWALI

———-

Wishing a great Diwali that is all set to brighten your days with prosperity, warmth, success and the very best that life can offer, now nd forever. HapPy DiWaLi

———-

Diwali night is full of lights, may your life be filled with colors and lights of happiness. Happy Diwali!

———-

Diwali night is full of lights, may your life be filled with colors and lights of happiness.

———-

Fortunate is the one who has learned to Admire, but not to envy.

———-

Good Wishes for a joyous Diwali and a Happy New Year with a plenty of Peace and Prosperity.

———-

As your celebrate this holy occasion, the most loving thoughts and wishes are for you… May the beauty of Diwali fill your world and your heart and may the love that is always yours, bring you endless joy. Have A Wonderful Diwali And New Year!

———-

Wishing u and Ur family a very “HAPPY DIWALI”.

———-

With a hope that you attain success and bliss with every light that is lit on the day of DIWALI –Happy Diwali

———-

Diwali night is full of lights, may your life be filled with colors and lights of happiness. Happy Diwali!

———-

Happy Diwali Status collections

Wishing you a year rich with wisdom, light and love… Happy Diwali

———-

Let me make your Diwali more colorful with the lights of wishes of my heart. Happy Diwali..

———-

Lets fill our home with prayers and lights not with fumes and crackers – Happy Diwali

———-

my greeting to you for happiness, peace, progress and prosperity in your life.. Enjoy and celebrate.. Happy Diwali.

———-

May the Divine Light of Diwali Spread into your Life Peace, Prosperity, Happiness and Good Health. Happy Diwali

———-

Have a crackling Diwali. May this season bring good luck and happiness to u!

———-

Life with you is like diwali, so lets promise to be together like this forever. Wish you a very Happy Diwali..

———-

Wish you and your family a bombastic Diwali, Have loads of fun and loads of masti.. haPpY dIwALi

———-

Diwali night is full of lights, may your life be filled with colors and lights of happiness. Happy Diwali..

———-

May you live your life like the festival of Diwali, happy healthy and wealthy. A Very Very Happy Diwali..

———-

Let me make your Diwali more colorful with the lights of wishes of my heart. Happy Diwali..

———-

The festival of lights is just around the corner wish you all a Very Happy Diwali..

———-

Life with you is like diwali, so lets promise to be together like this forever. Wish you a very Happy Diwali..

———-

Wish you and your family a bombastic Diwali, Have loads of fun and loads of masti..

———-

May you live your life like the festival of Diwali, happy healthy and wealthy. A Very Very Happy Diwali..

———-

The festival of light is full of delight Let me double the charm of your diwali night Happy Diwali!

———-

Let me make your Diwali more colorful with the lights of wishes of my heart. Happy Diwali..

Related Posts you Like:

———-

Happy Diwali Status for Parents Wish you and your family a bombastic Diwali, Have loads of fun and loads of masti. Happy Diwali

———-

Let this diwali burn all your bad times and enter you in good times.

]]>

Happy Diwali 2018

Happy Diwali 2018

Hello Guys. Wishig you a very very Happy Diwali. I know you want to wish your friends and family Happy Diwali. But how to wish Diwali to someone? Don’t worry. Here are some Happy Diwali 2018 Quotes, wishes and Greetings.

Hello Guys. Wishig you a very very Happy Diwali. I know you want to wish your friends and family Happy Diwali. But how to wish Diwali to someone? Don’t worry. Here are some Happy Diwali 2018 Quotes, wishes and Greetings.  *****2018 Diwali Wishes*****

*****2018 Diwali Wishes*****

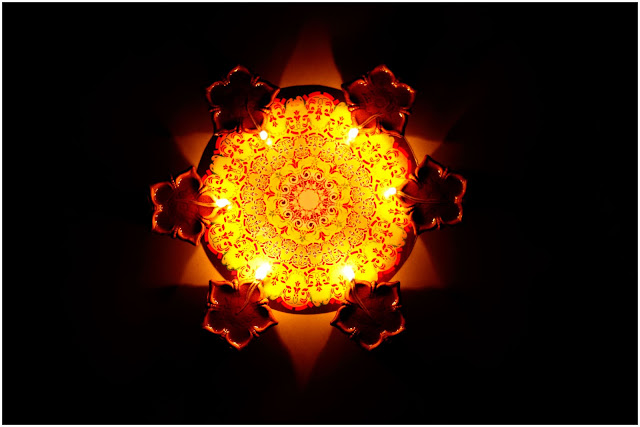

You can now wish all your friends, family and others easily in this festive season. You can wish many whatsapp and facebook users with our Diwali collection. Get ready to enjoy with cute diwali status and images and describe your happiness to others. There are different types of cool, love, sad, funny and diwali status for your whatsapp. Update it in your profile immediately and share it with all your loved ones to wish them Happy Deepavali 2018.

You can now wish all your friends, family and others easily in this festive season. You can wish many whatsapp and facebook users with our Diwali collection. Get ready to enjoy with cute diwali status and images and describe your happiness to others. There are different types of cool, love, sad, funny and diwali status for your whatsapp. Update it in your profile immediately and share it with all your loved ones to wish them Happy Deepavali 2018.

Diwali is an amazing and the most important festival of Hindus. It is celebrated with great excitement and vigor among the people. This year, the festival will be observed on October, 19, 2017. We assure you to connect with others in this festive season in your desired language. Our Diwali Status for Whatsapp & whatsapp diwali special status has clear and deep meaning inside. You may change your status with our collection or may even message your loved ones to give them Diwali wishes and greetings 2017.

Diwali is an amazing and the most important festival of Hindus. It is celebrated with great excitement and vigor among the people. This year, the festival will be observed on October, 19, 2017. We assure you to connect with others in this festive season in your desired language. Our Diwali Status for Whatsapp & whatsapp diwali special status has clear and deep meaning inside. You may change your status with our collection or may even message your loved ones to give them Diwali wishes and greetings 2017.

There are many interesting quotes on Diwali available on the Internet, but the choice of some good quotes is pretty hard. Worry not! We ’ve compiled a list of handful best Diwali Quotes, which will help you to wish your loved ones and make them happy that you’ve just wished them on this occasion. All of the listed Unique Diwali Wishes Quotes are suitable to share with the person of any age group. So, you can share the same with your Younger brothers, Elder Brothers, Sisters, Mother, Father and even GrandFathers too.

There are many interesting quotes on Diwali available on the Internet, but the choice of some good quotes is pretty hard. Worry not! We ’ve compiled a list of handful best Diwali Quotes, which will help you to wish your loved ones and make them happy that you’ve just wished them on this occasion. All of the listed Unique Diwali Wishes Quotes are suitable to share with the person of any age group. So, you can share the same with your Younger brothers, Elder Brothers, Sisters, Mother, Father and even GrandFathers too.